Arrano Capital

Arrano Capital, which is the blockchain arm of Venture Smart Asia Limited ("VSA"), announced on 20 April 2020 the launch of Hong Kong's first regulated virtual asset fund. The fund, which tracks the price of Bitcoin, provides Professional Investors (as defined under the Securities & Futures Ordinance) access to Bitcoin through a traditional fund structure. Venture Smart Asia Limited has a Type 1, Type 4 and Type 9 SFC license.

A condition of VSA's SFC regulatory approval is that "the licensee shall comply with the "Proforma Terms and Conditions for Licensed Corporations which Manage Portfolios that Invest in Virtual Assets" ("T&C") issued by the Securities and Futures Commission ("SFC") on 4 October 2019 and any amendments made to the T&C thereafter. Any changes to the information previously provided to the SFC, including changes to fund structures and/or service providers (e.g. custodians, administrators and virtual asset trading platforms), should only be made and/or adopted with the SFC's written consent."

The guidelines in the T&Cs are robust and stringent. For instance, a virtual asset fund manager must assess the features and characteristics of the different custodial arrangements such as the hardware and software infrastructure; the security controls over key generation, storage, management and transaction signing; and the process of handling blockchain forks. That said, the T&Cs are also substantially similar to the Fund Manager Code of Conduct: it should not come as a surprise that the SFC expects crypto-funds to adhere to at least the same standard as that applied to funds holding more conventional assets.

This is exciting news and may pave the way forward for other pure-crypto funds in Hong Kong.

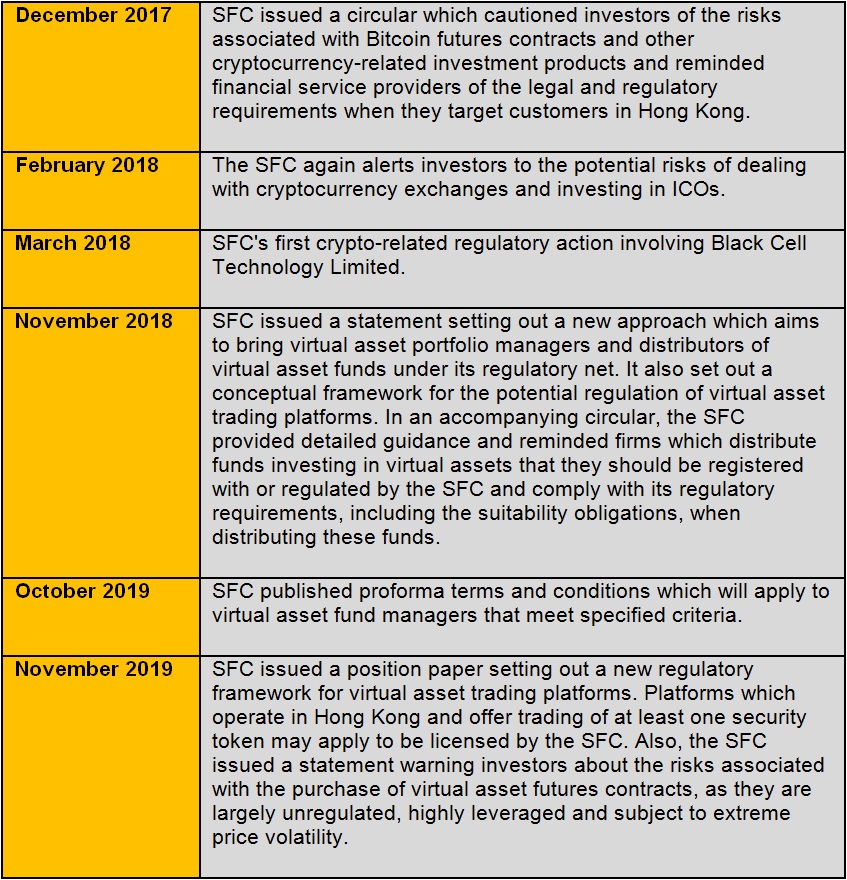

We also set out below a summary of key recent SFC developments in the crypto-space.

Also, in the 2020 – 2021 budget speech, Hong Kong's Financial Secretary announced that Hong Kong may strengthen its policing of the cryptocurrency sector to conform with international AML regulations. The new regulations could target virtual asset service providers (or, VASPs). Plans for these new regulations are further to FATF's virtual asset guidance released in 2019.

- Jill Wong & Sonya Mahbubani

關於本行

何韋律師行是一所香港獨立律師行,其律師經驗豐富,具創造性及前瞻性思維。

我們的主要業務領域包括:企業/商業事務及企業融資;商事及海事爭議解決;醫療疏忽及醫護;保險、人身傷害及專業彌償保險;僱傭;家庭及婚姻;物業及建築物管理;銀行和金融服務/企業監管及合規事宜。

作為一家獨立的律師行,我們能將法律和商業上利益衝突的情況減至最低,為各行各業的客戶處理各種法律事務。本行合夥人在香港發展事業多年,對國際業務及亞洲地區業務有深刻的了解。

免責聲明: 本電郵所載資料及任何附件僅提供作就參考用途,並不旨在提供法律意見。如閣下有任何疑問,請電郵至[email protected]。