Arrano Capital

Arrano Capital, which is the blockchain arm of Venture Smart Asia Limited ("VSA"), announced on 20 April 2020 the launch of Hong Kong's first regulated virtual asset fund. The fund, which tracks the price of Bitcoin, provides Professional Investors (as defined under the Securities & Futures Ordinance) access to Bitcoin through a traditional fund structure. Venture Smart Asia Limited has a Type 1, Type 4 and Type 9 SFC license.

A condition of VSA's SFC regulatory approval is that "the licensee shall comply with the "Proforma Terms and Conditions for Licensed Corporations which Manage Portfolios that Invest in Virtual Assets" ("T&C") issued by the Securities and Futures Commission ("SFC") on 4 October 2019 and any amendments made to the T&C thereafter. Any changes to the information previously provided to the SFC, including changes to fund structures and/or service providers (e.g. custodians, administrators and virtual asset trading platforms), should only be made and/or adopted with the SFC's written consent."

The guidelines in the T&Cs are robust and stringent. For instance, a virtual asset fund manager must assess the features and characteristics of the different custodial arrangements such as the hardware and software infrastructure; the security controls over key generation, storage, management and transaction signing; and the process of handling blockchain forks. That said, the T&Cs are also substantially similar to the Fund Manager Code of Conduct: it should not come as a surprise that the SFC expects crypto-funds to adhere to at least the same standard as that applied to funds holding more conventional assets.

This is exciting news and may pave the way forward for other pure-crypto funds in Hong Kong.

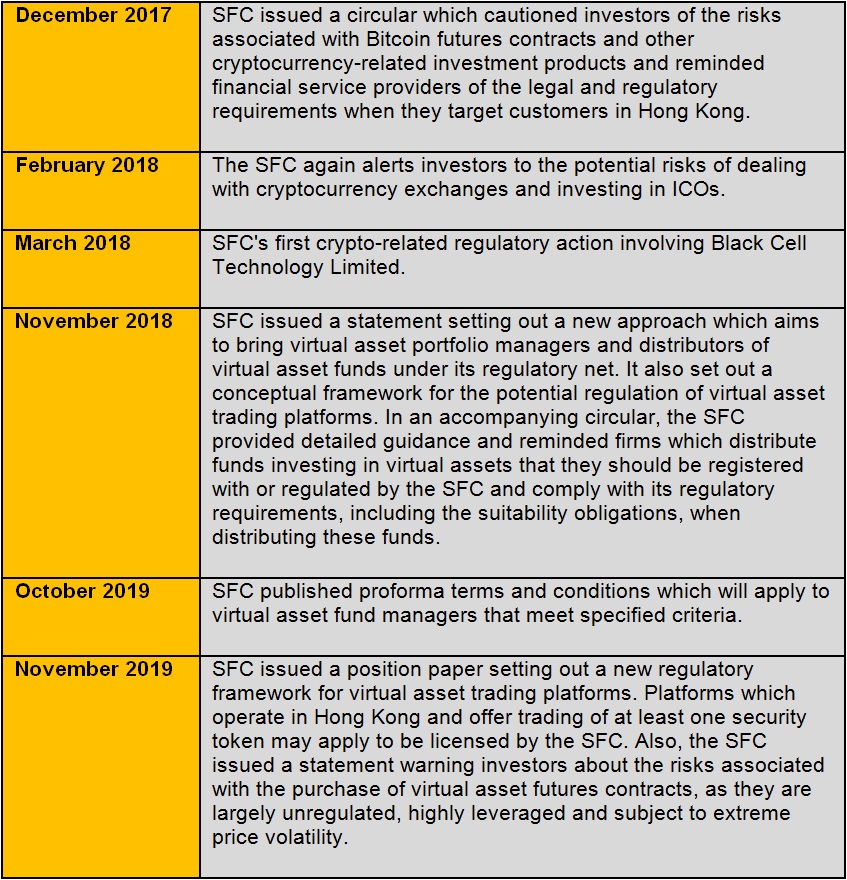

We also set out below a summary of key recent SFC developments in the crypto-space.

Also, in the 2020 – 2021 budget speech, Hong Kong's Financial Secretary announced that Hong Kong may strengthen its policing of the cryptocurrency sector to conform with international AML regulations. The new regulations could target virtual asset service providers (or, VASPs). Plans for these new regulations are further to FATF's virtual asset guidance released in 2019.

- Jill Wong & Sonya Mahbubani

About Us

Howse Williams is an independent law firm which combines the in-depth experience of its lawyers with a forward thinking approach.

Our key practice areas are corporate/commercial and corporate finance; commercial and maritime dispute resolution; clinical negligence and healthcare; insurance, personal injury and professional indemnity insurance; employment; family and matrimonial; property and building management; banking; fraud; financial services/corporate regulatory and compliance.

As an independent law firm, we are able to minimise legal and commercial conflicts of interest and act for clients in every industry sector. The partners have spent the majority of their careers in Hong Kong and have a detailed understanding of international business and business in Asia.

Disclaimer: The information contained in this article is intended to be a general guide only and is not intended to provide legal advice. Please contact [email protected] if you have any questions about the article.